Here’s your wrap for Mon, Oct 6 – Fri, Oct 10, 2025 (rounded to the dollar).

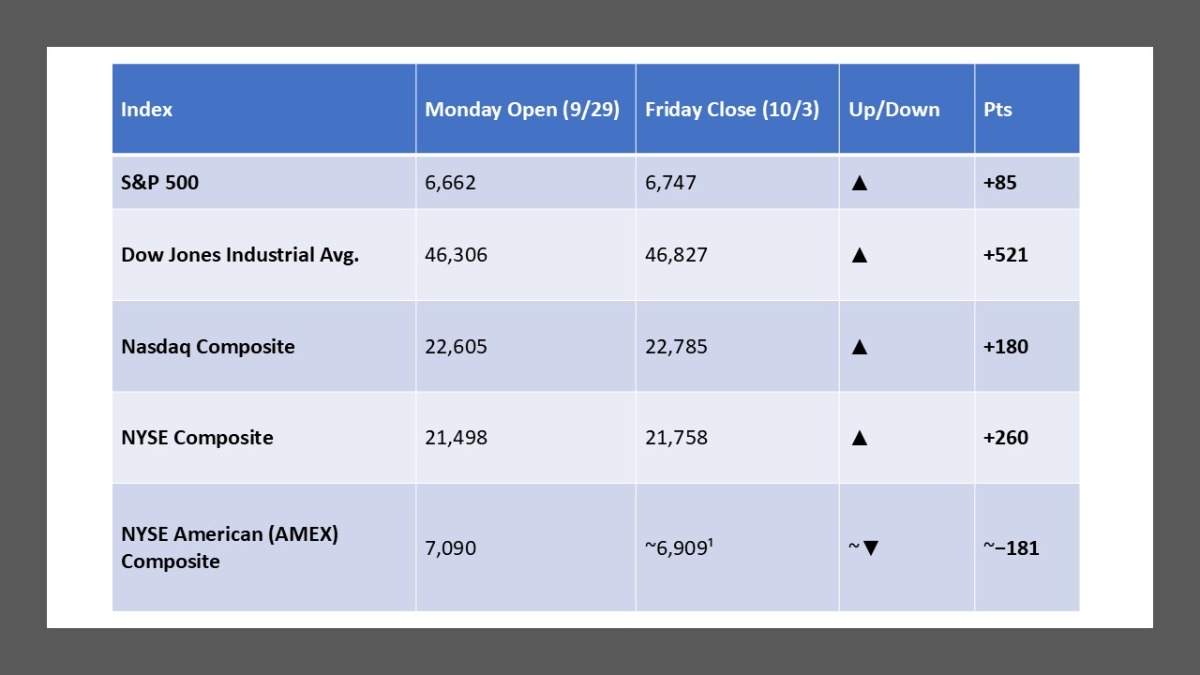

Weekly Market Summary:

Stocks fell for the week after a sharp Friday sell-off sparked by new U.S. tariff threats on China over rare-earths, with the S&P 500 down 2.7% on the day—its worst since April. The Dow −1.9% and Nasdaq −3.6% also slumped Friday as semiconductors led declines and volatility spiked. Earlier in the week, indexes hovered near highs before the trade headlines hit; by Friday’s close, weekly losses tallied S&P −2.4%, Dow −2.7%, Nasdaq −2.5%. Bond yields fell as investors rotated to safety, while oil slid and gold firmed, reflecting a classic risk-off session. A partial federal data blackout from the ongoing government shutdown kept traders leaning on Fed speak and earnings previews for direction.

Five Stocks Worth Watching:

- Nvidia (NVDA): High-beta AI bellwether hit hard in the tariff-risk tech selloff; Philly Semi Index fell >6%. Reuters

- Advanced Micro Devices (AMD): Dropped alongside chips on China trade headlines—key read-through for AI/server demand. Reuters

- Tesla (TSLA): Slid >2% with other megacaps exposed to China demand/supply chains. Reuters

- Qualcomm (QCOM): Under pressure amid reports of a Chinese antitrust probe; handset/China sensitivity in focus. Reuters

- MP Materials (MP): Rare-earths producer popped as U.S.–China minerals tensions escalated. New York Post

What The Prediction Markets Says (As Of October 10, 2025):

- Polymarket — October FOMC cut size: Dashboard shows the 25 bps cut outcome as the clear favorite into Oct 29.

- Kalshi — “Number of Fed cuts in 2025”: Contracts lean to 3 cuts as the modal path, with 2 cuts not far behind.

- PredictIt — 2026 U.S. House control: Ongoing, liquid market tracking which party wins the House in 2026.

- Smarkets — 2028 U.S. Presidential winner: Exchange board currently lists JD Vance ~27% as the leading single-name favorite.

- Manifold — 2025 U.S. government shutdown duration/occurrence: Active markets on whether a shutdown happens and for >5 days.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply