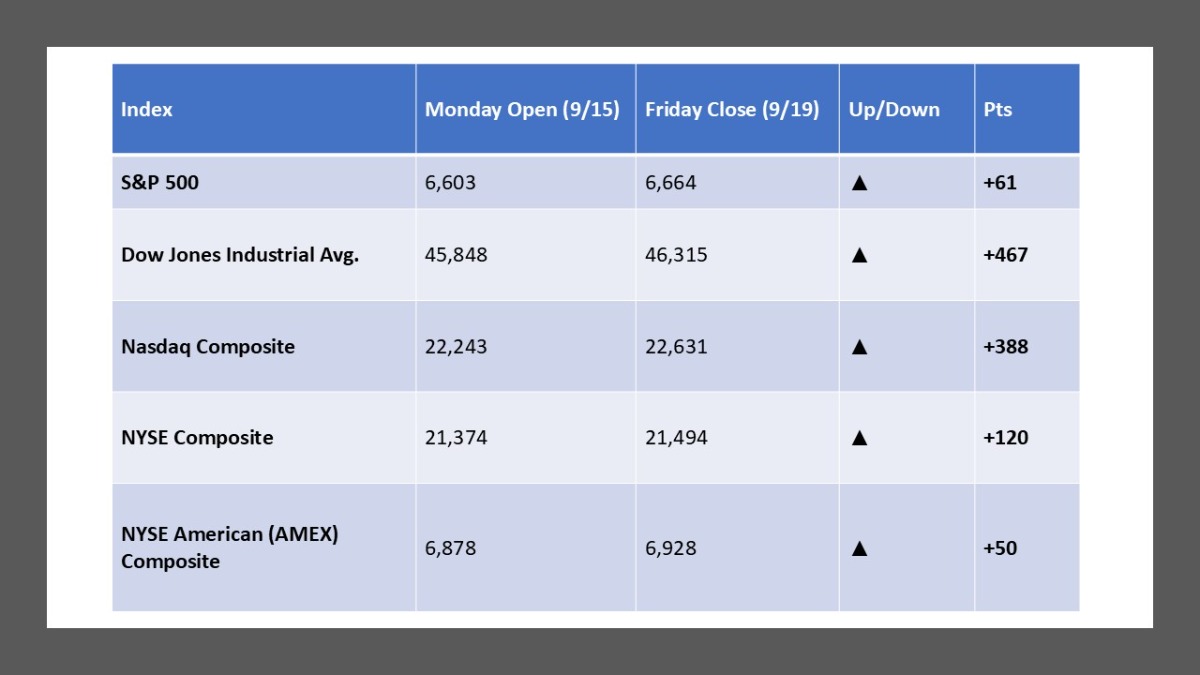

Here’s your wrap for Mon, Sep 15 – Fri, Sep 19, 2025 (all values rounded to the dollar).

Weekly Market Summary:

The Fed cut rates by 25 bps on Thursday, helping propel the S&P 500, Dow, and Nasdaq to record closes on both Thursday and Friday. A stunning 22.8% surge in Intel—after news that Nvidia took a $5B stake—ignited chips and lifted broader risk appetite. Friday’s trade also featured triple-witching and a pop in FedEx on an earnings beat, while small caps briefly tagged a record before fading. For the week, the S&P +1.2%, Dow +1%, and Nasdaq +2.2%, capping a three-week uptrend. Net-net: breadth improved into the cut, AI/semis reasserted leadership, and sentiment stayed constructive despite seasonal September chop.

Five Stocks Worth Watching:

- Intel (INTC) — Exploded +22.8% on Nvidia’s disclosed $5B stake, its biggest one-day jump since 1987.

- Nvidia (NVDA) — Rose ~3.5% alongside the Intel news; remains the market’s AI bellwether.

- FedEx (FDX) — Advanced on an earnings beat and cost discipline; a useful macro read on parcel demand.

- Apple (AAPL) — Gained after a JPM price-target hike; still a mega-cap sentiment driver.

- CrowdStrike (CRWD) — Jumped on a cluster of broker upgrades, keeping cybersecurity momentum intact.

What The Prediction Markets Says (As Of September 19, 2025):

- Polymarket — “Fed decision in September”: Flagship contract (very high volume) that just resolved to a 25 bp cut; traders now eye the next meeting on the Fed dashboard.

- Kalshi — “Number of Fed cuts in 2025”: Post-cut distribution leans to 3 cuts by year-end, with 2 cuts the next most popular path.

- PredictIt — “Which party wins the U.S. House in 2026?”: Ongoing order-book market for control of the chamber.

- Smarkets — “2028 U.S. Presidential Election Winner”: Liquid long-dated market (exchange pricing) that currently lists JD Vance as a narrow favorite among individual names.

- Manifold — “Fed decisions in 2025 (sequence)”: Community forecasting on the Cut/Pause/Cut sequencing across the Sep/Oct/Dec meetings.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply