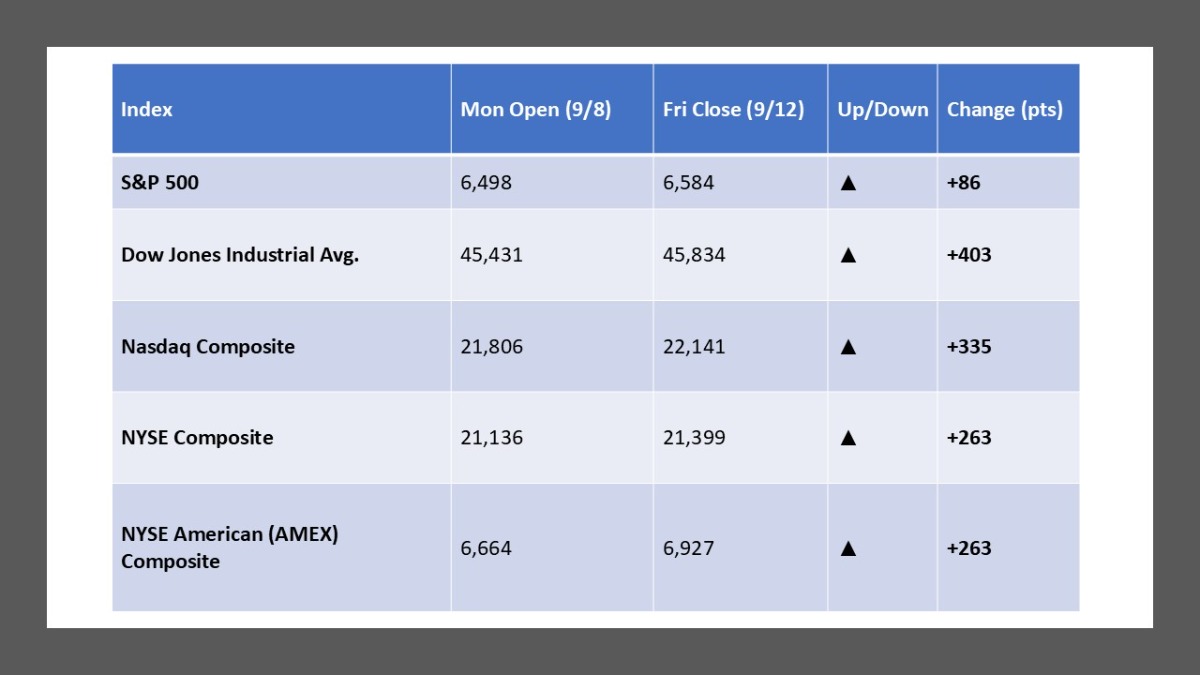

Here’s your wrap for Mon, Sep 8 – Fri, Sep 12, 2025 (markets were open Monday).

Weekly Market Summary:

Stocks hovered near records and extended weekly gains as traders leaned into expectations for a Fed rate cut next week, even after August CPI ran a bit hot. Thursday saw fresh all-time highs across the major averages, with the Dow topping 46,000 for the first time before a mixed, quieter finish on Friday. For the week, the S&P 500 +1.6%, Dow +1%, and Nasdaq +2%, underscoring ongoing leadership from growth/AI-linked names. Tech strength was fueled by upbeat Oracle commentary and a bid in semis, while cyclicals and health care were choppier. Macro tone stayed “risk-on” despite softer consumer sentiment and lingering tariff worries, as markets looked through to policy support.

Five Stocks Worth Watching:

- Tesla (TSLA): Helped propel the Nasdaq to record territory late week; a bellwether for high-beta risk.

- Micron (MU): Rallied on upbeat analyst calls and AI demand momentum.

- Oracle (ORCL): Strong AI-driven outlook buoyed software and chips; a key sentiment lever for the AI trade.

- UnitedHealth (UNH): Reaffirmed 2025 outlook; managed care remains a swing factor for the Dow.

- RH (RH): Slid on weaker results and a guidance cut tied to tariff headwinds—headline-sensitive name to watch.

What The Prediction Markets Says (As Of September 5, 2025):

- Polymarket — “Fed decision in September”: Markets are heavily pricing a 25 bps cut; recent round-ups peg the “cut” outcome in the high-80% range, matching the platform’s active contract for the Sept. 16–17 FOMC meeting.

- Kalshi — “How many Fed cuts in 2025?”: The distribution currently leans to 2 cuts (~42%) with 3 cuts close behind (~38%), reflecting uncertainty on how quickly the easing cycle proceeds.

- PredictIt — “Which party will win the U.S. House in 2026?”: As of now the market favors Democrats (~66¢) over Republicans (~34¢) to control the chamber after the midterms.

- Smarkets — “2028 U.S. Presidential Election Winner”: JD Vance ~27% is the current single-name favorite on the exchange’s main 2028 market, with others (e.g., Gavin Newsom ~16%) trailing.

- Manifold — “Will the Fed cut rates in September 2025?”: Community forecasting has this at ~97% Yes, in line with broader rate-cut expectations.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply