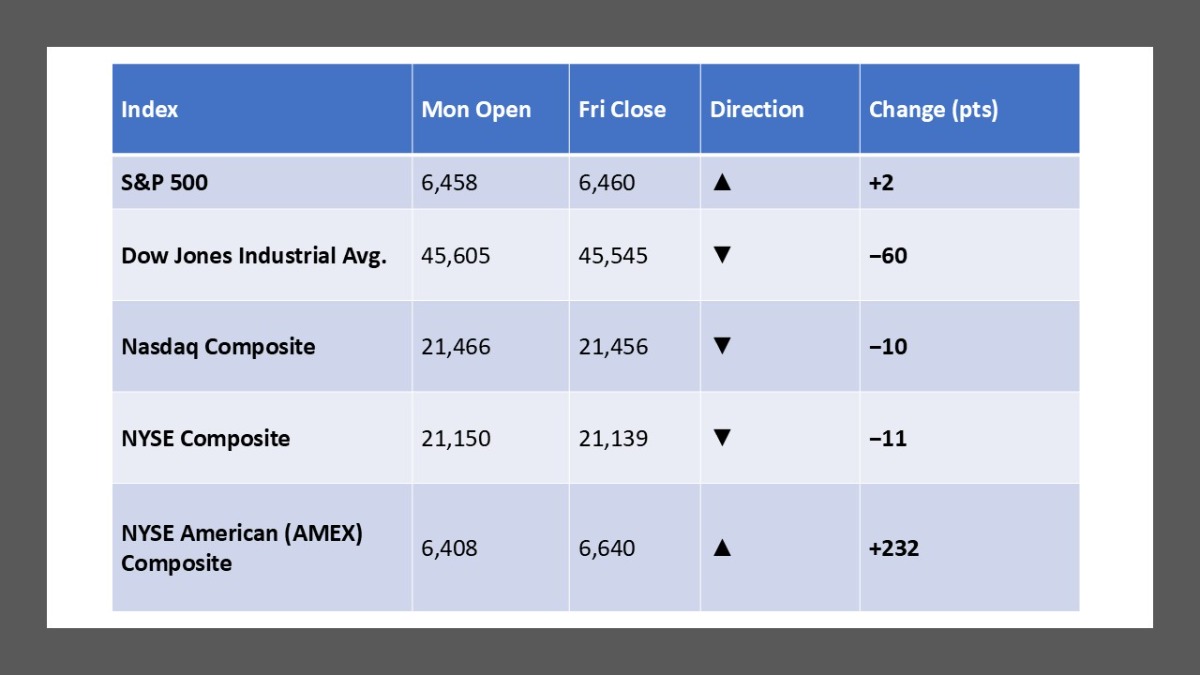

Here’s your weekly wrap for 9/1 – 9/5/2025. Note: U.S. markets were closed on Mon, Sep 1 (Labor Day), so the “Monday open” uses Tuesday’s open (Sep 2).

Sources: S&P 500 (Tue open & Fri close), DJIA (Tue open & Fri close), NASDAQ Composite (Tue open & Fri close) from Investing.com historical tables; NYSE Composite Tue open from Investing.com, Fri close/late trade from Reuters; NYSE American Composite (Tue open & Fri close) from Yahoo Finance.

Weekly Market Summary

After the long weekend, stocks stumbled on Tuesday as higher yields and policy uncertainty weighed on risk assets. Midweek strength followed, and the S&P 500 notched a record close on Thursday before momentum faded. Friday’s weaker-than-expected August jobs report (22k payrolls) initially boosted rate-cut hopes but indexes finished slightly lower by the close. For the week, the S&P 500 and Nasdaq eked out gains (+0.3% and +1.1%), while the Dow slipped (-0.3%). Sector-wise, banks lagged while AI-exposed semis saw dispersion: Broadcom rallied on earnings as Nvidia and AMD retreated.

Five Stocks Worth Watching

- Broadcom (AVGO): Surged on strong results and upbeat AI revenue outlook into 2026.

- Lululemon (LULU): Sank ~19% on weak U.S. sales and guide cut, making it a high-volatility name to watch.

- Kenvue (KVUE): Dropped sharply after a report that the U.S. health secretary may warn about Tylenol use in pregnancy—headline-sensitive.

- Tesla (TSLA): Popped after a proposed $1T compensation package for Elon Musk resurfaced investor focus—sentiment catalyst.

- AMD (AMD): Notable underperformer this week amid broader chip volatility; watch for follow-through vs. peers.

What The Prediction Markets Says (As Of September 5, 2025):

- Sept 17 FOMC: Kalshi markets price a 25 bps cut as the base case (≈79% “Yes” on Cut 25 bps); hold ≈17%, >25 bps cut ≈5%.

- How many 2025 cuts? “Exactly 2 cuts” is the modal outcome (~44%) on Kalshi’s Rate Cuts in 2025 market.

- Unemployment (U-3) next reading: Kalshi’s Unemployment in September shows “Above 4.2%” as the favored side (site banner shows ~68% Yes).

- CPI Aug 2025 (YoY): Hot market around whether headline CPI YoY exceeds 2.8% (Kalshi), drawing elevated trading interest.

- CPI Aug 2025 (m/m): Another Kalshi line on CPI m/m > 0.3% is drawing action ahead of next week’s data.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply