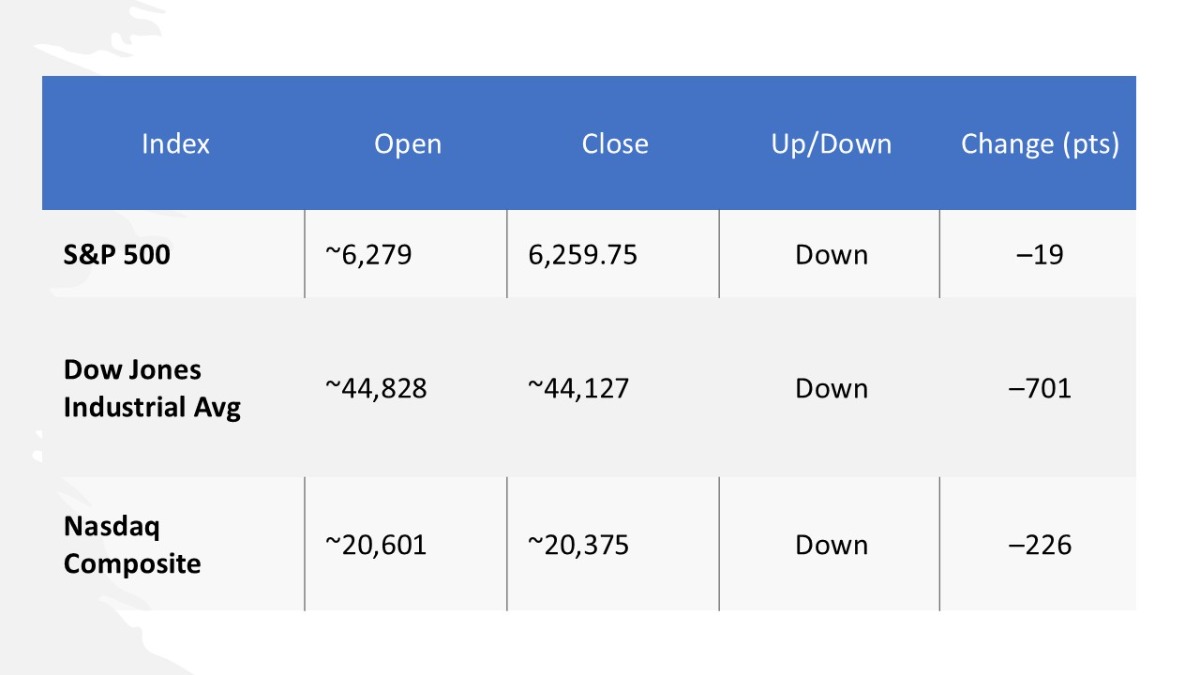

Here’s how the major U.S. stock indexes performed from Monday, June 23 to Friday, June 27, 2025:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary

The week kicked off at fresh record highs—S&P reached ~6,279 and Nasdaq around ~20,601—as investors cheered strong jobs data and eased tech export restrictions. Markets then dropped sharply on Monday after President Trump announced new tariffs on Canada and other nations, pushing the S&P down ~0.8% and the Dow ~0.9%. Optimism returned mid‑week as the Fed maintained a cautious stance and oil prices stabilized with broader gains across all 11 S&P sectors. By Friday, however, inflation worries re‑emerged due to fresh tariffs, dragging the S&P and Nasdaq lower and eclipsing the week’s earlier rally. Overall, the week closed modestly negative—S&P down ~20 pts, Dow off ~700 pts, Nasdaq down ~226 pts—on the back of trade tensions despite resilient economic data and an upbeat bond market.

Stocks Worth Watching

- Tesla (TSLA): Dropped nearly 7% on Monday after Elon Musk’s “American Party” political move unsettled investors.

- Nextracker (NXT): Market favorite among recent IPOs; posted strong Q2 results (earnings +34%) but is testing a key buy point.

- Delta Air Lines (DAL): Helped fuel mid‑week gains after impressive earnings boosted airline stocks and contributed to S&P/Nasdaq reaching new highs.

- Apple (AAPL): Saw a modest 1.7% drop on Monday despite continued strength in iPhone sales.

- Uber (UBER): Ran to an all-time high earlier in the week—up ~3.3%—as investors cheered its strong performance outlook.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.