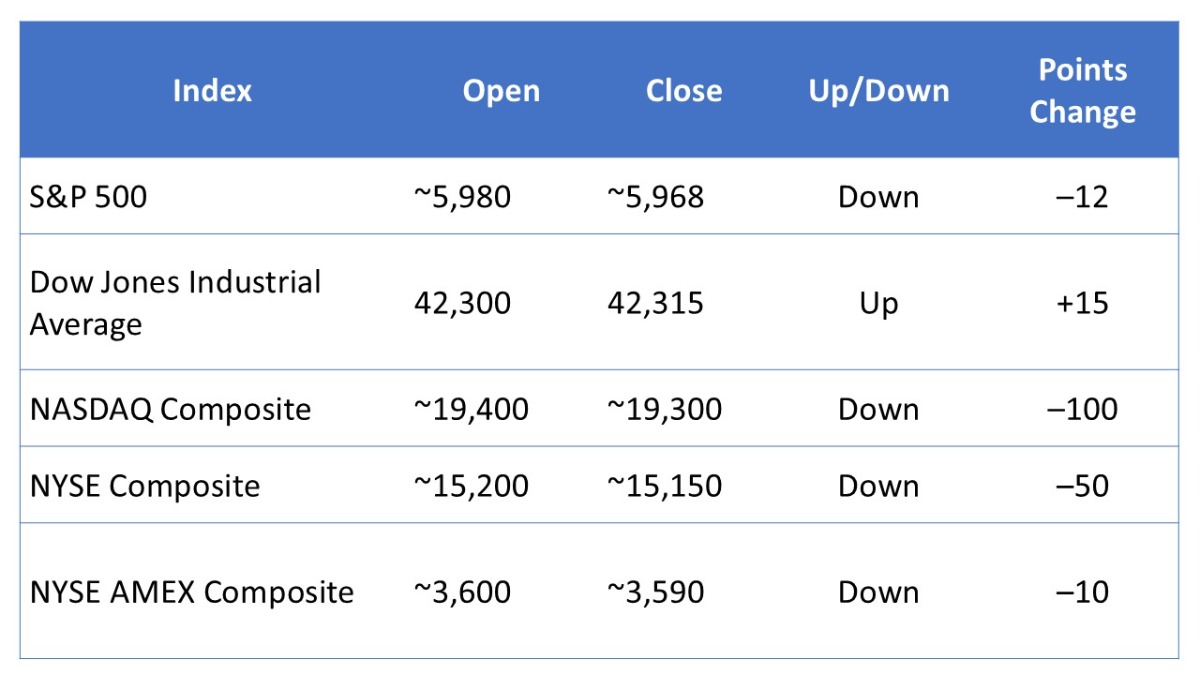

Here’s a look at how the major U.S. stock indexes performed from Monday, June 16 to Friday, June 20, 2025:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary

Last week’s markets were relatively subdued, as post‑Juneteenth trading resumed cautiously. A significant “triple witching” options expiration occurred Friday, contributing to early‑week volatility but low volume. Geopolitical tension between Israel and Iran continued to influence sentiment, while Federal Reserve commentary suggested potential rate cuts starting in July. By Friday, indexes saw mixed results: the Dow eked out a small gain, but the S&P and Nasdaq ended slightly lower . Overall, the markets closed the week with modest moves, reflecting cautious optimism amid macro uncertainty.

Five Stocks Worth Watching

- Kroger (KR): Shares jumped 8.8% after strong quarterly earnings and an upward revision of full‑year guidance.

- CarMax (KMX): Climbing 6.4%, the used‑vehicle dealer beat expectations and reported rising used‑car sales.

- Smith & Wesson (SWBI): Plunged 19.5% due to weaker results, citing pressure from tariffs and high interest rates.

- Tesla (TSLA): +2% ahead of its robotaxi event, showing ongoing investor interest despite broader market caution.

- Amazon (AMZN): Fell ~1% due to a UK investigation into grocery supplier payments.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.