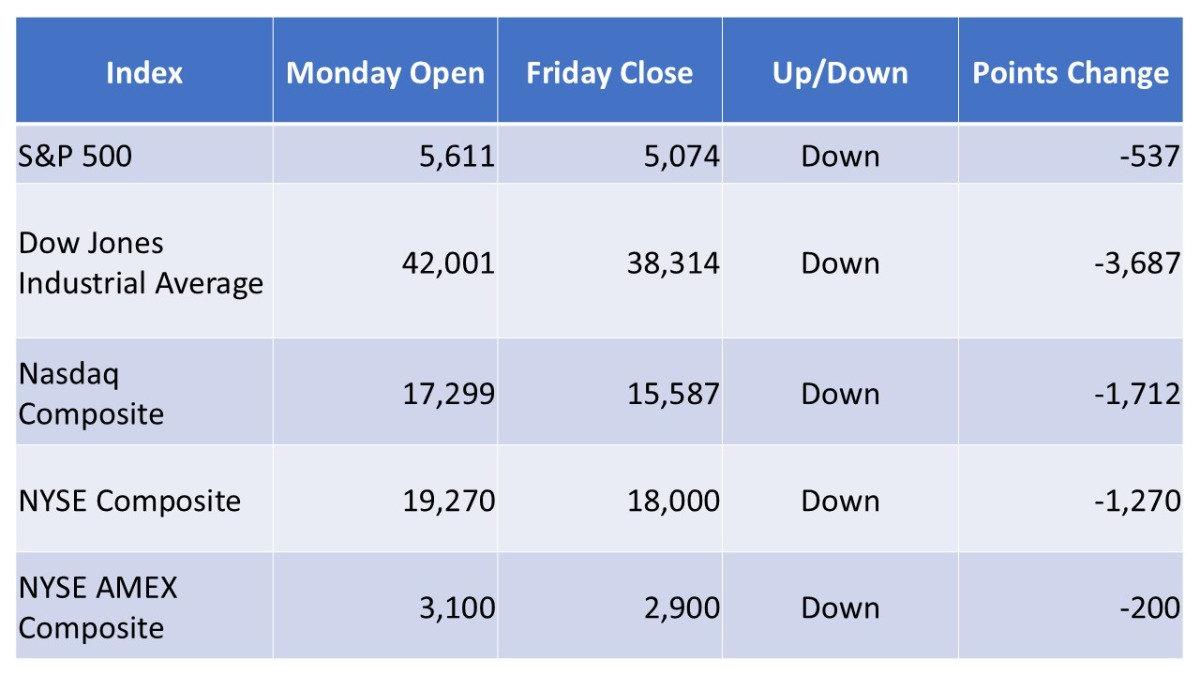

During the week of March 31 to April 4, 2025, U.S. stock markets experienced significant volatility, culminating in substantial losses by week’s end. Below is a summary table of the performance of major stock market indexes:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary:

The week began with a modest recovery on Monday, as the Dow Jones Industrial Average rose 417.86 points (1%) to 42,001.76, while the S&P 500 and Nasdaq Composite had mixed results. However, investor sentiment deteriorated midweek following President Donald Trump’s announcement of new tariffs on imports, escalating trade tensions with China. In retaliation, China imposed a 34% levy on U.S. imports, intensifying fears of a prolonged trade war. These developments led to a sharp sell-off in the markets, with the Dow plunging over 2,200 points on Friday, marking its worst performance since the COVID-19 pandemic. The S&P 500 and Nasdaq Composite also experienced significant declines, with the Nasdaq entering bear market territory. Federal Reserve Chair Jerome Powell warned that the escalating tariffs could lead to higher inflation and slower economic growth, adding to investor concerns.

Stocks Worthy of Attention:

- Apple Inc. (AAPL): The tech giant’s stock declined significantly amid concerns over increased production costs due to new tariffs.

- JPMorgan Chase & Co. (JPM): Shares fell over 7% as financial stocks were hit hard by recession fears stemming from escalating trade tensions.

- Amazon.com Inc. (AMZN): The e-commerce leader’s stock price dropped 4.3% on Monday, contributing to the Nasdaq’s decline.

- Stellantis N.V. (STLA): The automaker announced consumer discounts in response to new auto tariffs, reflecting the industry’s challenges amid the trade war.

- Nintendo Co., Ltd. (NTDOY): The gaming company’s decision to postpone Switch 2 pre-orders highlighted supply chain concerns due to the tariffs.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply