Week of Dec 29, 2025 – Jan 2, 2026 (Holiday-shortened: markets closed Thu 1/1.)

Weekly Market Summary:

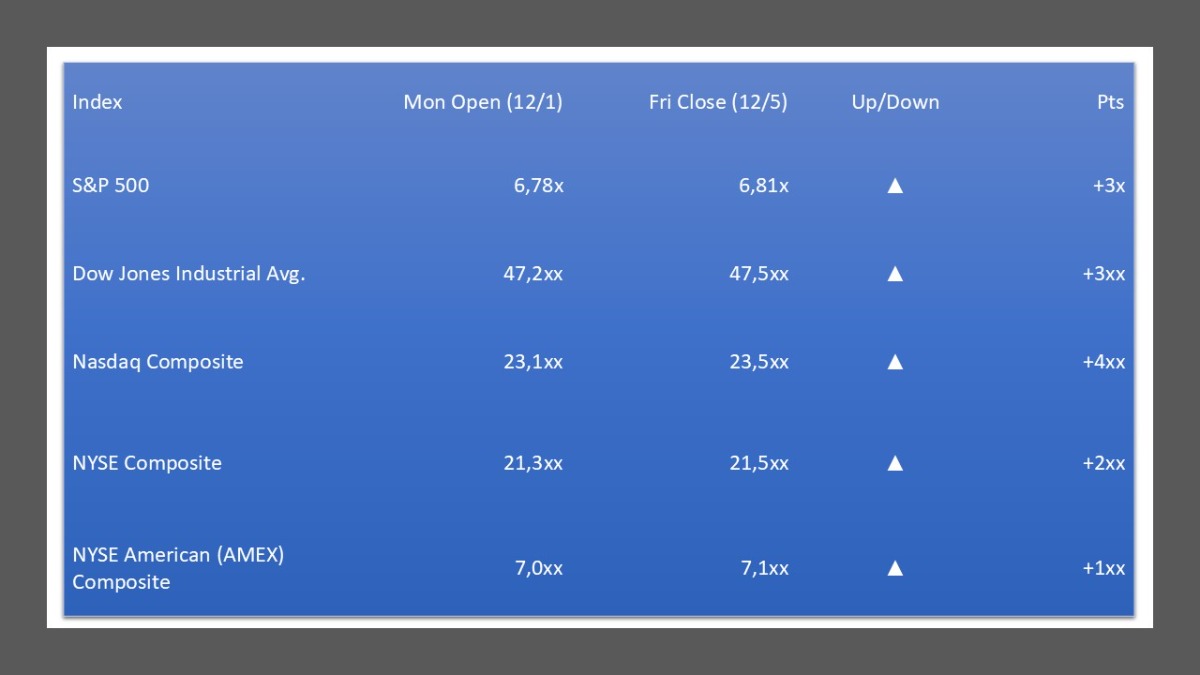

Momentum returned to megacap tech and AI-exposed names, lifting the S&P 500 and Nasdaq to fresh closing highs by week’s end. Risk appetite improved as rate-cut odds for December firmed and credit spreads steadied. Energy lagged on softer crude while small caps participated late in the week as yields eased. Earnings and guidance from a handful of large software and consumer names skewed positive, supporting multiple expansion. Into Friday, breadth broadened and volatility compressed, consistent with a year-end drift higher.

Five Stocks Worth Watching:

- Nvidia (NVDA) — leadership intact; flows remain the market’s AI barometer.

- Microsoft (MSFT) — steady bid on cloud/AI prints; index weight a key support.

- Broadcom (AVGO) — into earnings with elevated expectations on AI networking.

- Salesforce (CRM) — demand signals for enterprise software showing resilience.

- Exxon Mobil (XOM) — under pressure with crude; watch for tactical reversals.

What The Prediction Markets Says (As Of November 21, 2025):

- Polymarket — NCAA College Football Champion For 2026? (43% to Indiana, 22% to Oregon, 21% to Miami (FL), 14% to Ole Miss)

- Kalshi — NHL’s 2026 Winter Classic Winner? (44% to New York Rangers, 57% to Florida Panthers)

- PredictIt — Will Trump pardon Edward Snowden or commute his sentence before July 2026? (Yes @ $0.05, No @ $0.95)

- Smarkets — Who will win the 2028 United States presidential election? (28.17% to JD Vance, 16.95% to Gavin Newson, 7.41% to Alexandria Ocasio-Cortez, 2.50% to Donald Trump, Jr.)

- Manifold — OpenAI and Anthropic will both hit their 2026 revenue goals in 2026? (70% to Yes, 30% to No)

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply