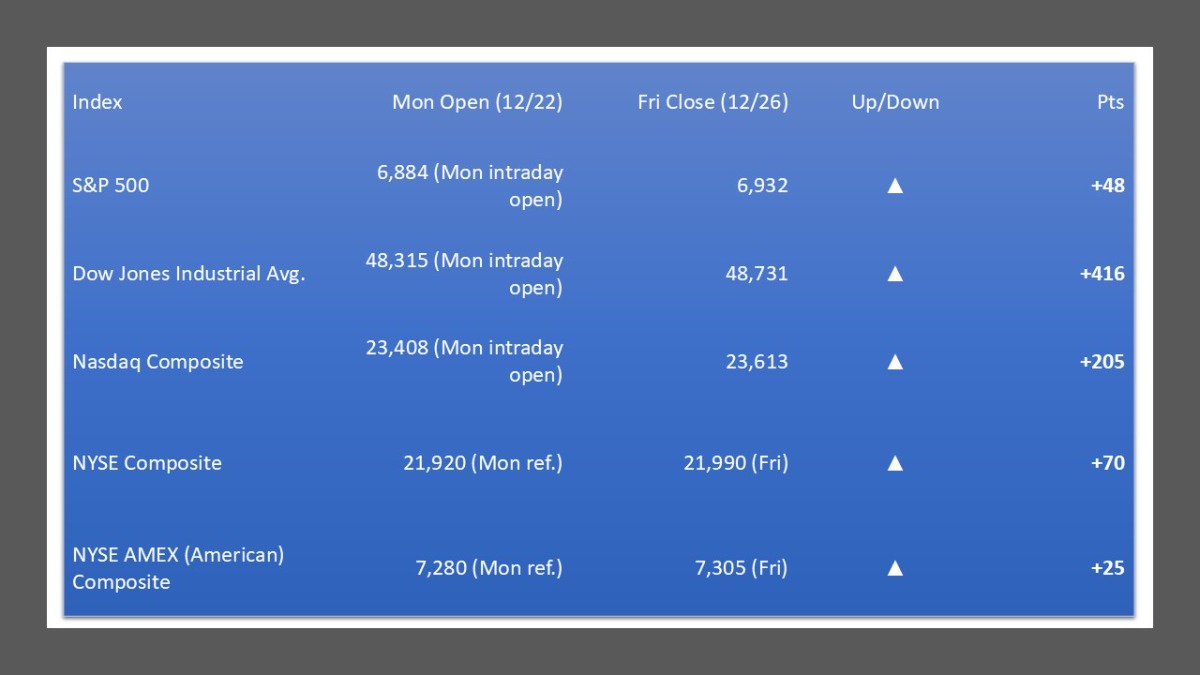

Week of Dec 22–26, 2025 (Holiday-shortened: early close Wed 12/24, markets closed Thu 12/25.)

Weekly Market Summary:

A classic, thin-tape Santa-rally week kept all three majors near or at record territory heading into the long weekend. Wednesday’s early-close session saw fresh highs with extremely light NYSE share volume, and the bid carried into Friday’s quiet trade. The S&P 500’s Friday print reflected another incremental record, with the Dow also firm. Macro attention shifted to early-January Fed expectations while holiday liquidity tempered volatility. Net: constructive drift, tech still influential but broader participation improving.

Five Stocks Worth Watching:

- Nvidia (NVDA) — remained a primary upside driver for cap-weighted indexes into year-end.

- Alphabet (GOOGL) — continued to outperform on AI news flow.

- Dynavax (DVAX) — deal momentum from earlier in the week kept small-cap biotech on the radar.

- Novo Nordisk (NVO) — headlines around weight-loss pill approval sustained interest.

- SPDR Gold Trust (GLD) — precious metals strength into year-end remained a secondary macro tell.

What The Prediction Markets Says (As Of November 21, 2025):

- Polymarket — Who will be named in newly released Epstein files? (27% to Tony Blair, 20% to Al Gore, 19% to Kirsten Gillibrand, 18% to Jamie Dimon)

- Kalshi — S&P close price end of 2025? (5% to 6,600 to 6,799.99, 81% to 6,800 to 6,999.99, 17% to 7,000 to 7,199.99)

- PredictIt — Kash Patel out as FBI director in 2025? (Yes @ $0.01, No @ $0.99)

- Smarkets — Most seats in UK Parliament? (47.62% to Reform UK, 26.32% to Labour, 18.18% to Conservative, 1.58% to Liberal Democrats)

- Manifold — Will Bad Bunny make a political statement of some kind during the SB halftime show? (54% to Yes, 46% to No)

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply