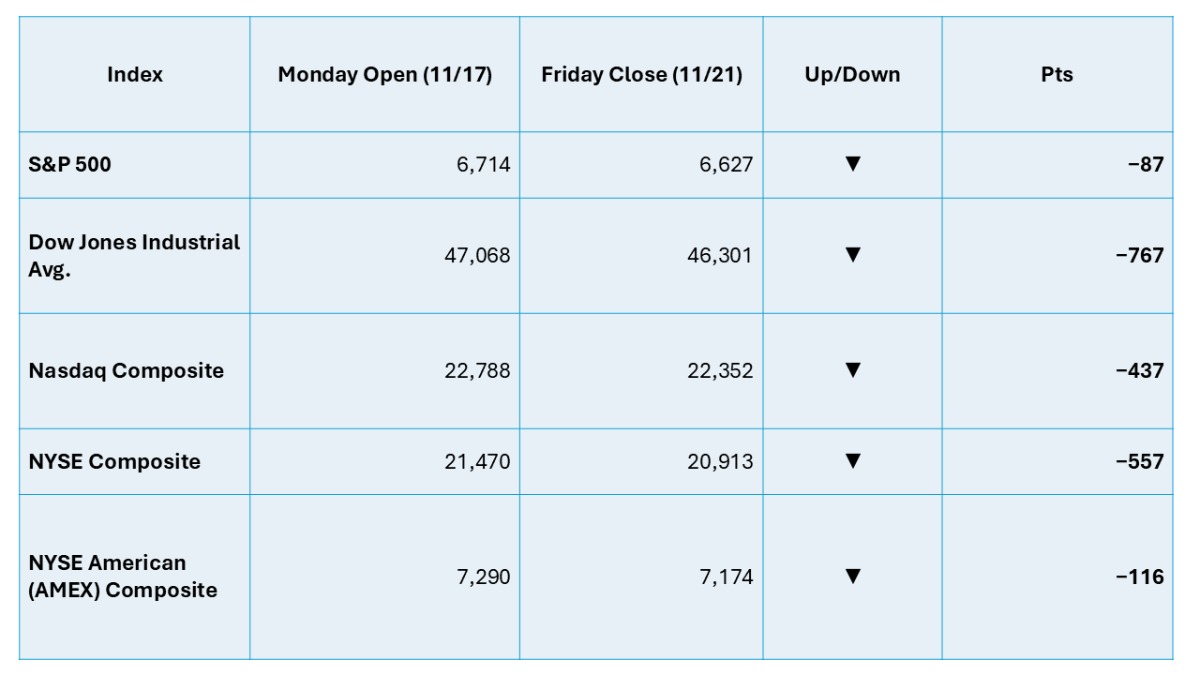

Here’s your wrap for Mon, Nov 17 – Fri, Nov 21, 2025 (rounded to the dollar).

Weekly Market Summary:

Stocks were broadly lower week-over-week as tech weakness and valuation worries dominated, despite a sharp Friday rebound on rising odds of a December Fed cut. Monday opened with selling—AI leaders led declines—setting a cautious tone. Thursday’s slide accelerated the weekly damage, with the S&P 500 −1.6% and the Nasdaq −2.2% on the day. By Friday, headlines and Fed-watching pushed risk back on, trimming losses into the close even as the week stayed negative overall. Macro chatter centered on rate-cut probabilities after NY Fed’s Williams signaled cuts “in the near term,” stoking intraday volatility.

Five Stocks Worth Watching:

- Nvidia (NVDA): In focus all week; Friday chatter about potential China chip allowances (H200) helped stabilize sentiment after heavy tech selling.

- Eli Lilly (LLY): Crossed the $1T market-cap milestone, underscoring health-care leadership amid tech rotation.

- Ross Stores (ROST): Earnings strength made it a notable gainer into week’s end.

- Gap (GAP): Post-earnings pop kept retailers on traders’ radar.

- Intuit (INTU): Mentioned among notable movers; software names showed dispersion around prints and guidance.

What The Prediction Markets Says (As Of November 21, 2025):

- Polymarket — What will the Fed do at the upcoming meetings? (66% on a 25 bps cut, 32% on no change)

- Kalshi — How low will Bitcoin get this year? ( 71% say below $80,000, 27% say below $70,000)

- PredictIt — Who will be the first Cabinet member to leave in 2025? (Scott Bessent @ $0.02, Pete Hegseth @ $0.02, Kristi Noem @ $0.02)

- Smarkets — Donald Trump to serve as president for 9+ years by end of 2030? (92.59% to No, 8.00% to Yes)

- Manifold — Will Apple block Google’s Airdrop implementation before end of 2025? (23% to Yes, 77% to No)

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply