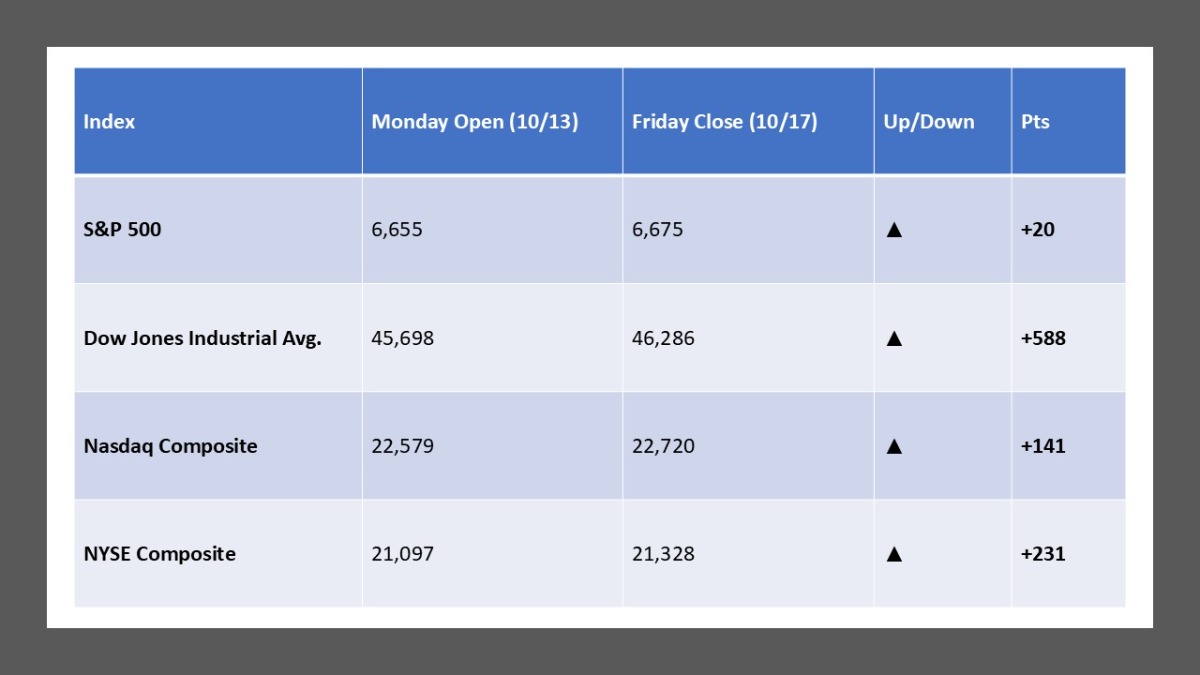

Here’s your wrap for Mon, Oct 13 – Fri, Oct 17, 2025 (rounded to the dollar).

Weekly Market Summary:

Stocks rebounded from last week’s swoon and finished Friday higher across the board as bank shares steadied and trade worries cooled; the S&P 500, Dow and Nasdaq each rose roughly 0.6% on the day. Supportive Fed speak added to the bid with Governor Waller and St. Louis Fed’s Musalem both leaning toward another 25 bp cut at the Oct. 29 meeting. Headline risk eased after President Trump called 100% China tariffs “unsustainable” and confirmed a plan to meet President Xi, helping risk appetite. By week’s end, global strategists (e.g., UBS) were upgrading equities on AI tailwinds while gold cooled and yields steadied—consistent with a “risk-on” lean. Net-net, it was the best week in ~2 months for U.S. stocks as credit jitters abated and rate-cut odds stayed elevated.

Five Stocks Worth Watching:

- Zions Bancorp (ZION) — at the center of the week’s regional-bank scare and rebound; volatility likely persists as loan-quality headlines develop.

- Western Alliance (WAL) — whipsawed by fraud-related litigation headlines, then recovered alongside peers.

- Truist (TFC) — helped steady the group with better-than-expected earnings, a key tell for credit sentiment.

- Fifth Third (FITB) — another regional posting resilient results; trades as a barometer for the KRE cohort.

- American Express (AXP) — a notable Dow contributor Friday as financials rebounded, worth watching into card-spend updates.

What The Prediction Markets Says (As Of October 10, 2025):

- Polymarket — October FOMC cut size: Markets price a ~94–95% chance of a 25 bp cut on Oct. 29 (dashboard + event page).

- Kalshi — “Number of Fed cuts in 2025”: Traders lean to two–three total cuts by year-end on the rate-cuts count contract.

- PredictIt — 2026 U.S. House control: Ongoing high-interest market tracking which party wins the House in 2026.

- Smarkets — 2028 U.S. Presidential winner: Exchange odds currently show JD Vance ~29% as the leading single-name favorite among individuals.

- Manifold — 2025 U.S. government shutdown (existence/length): Active community markets on whether a shutdown occurs and how long it lasts.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply