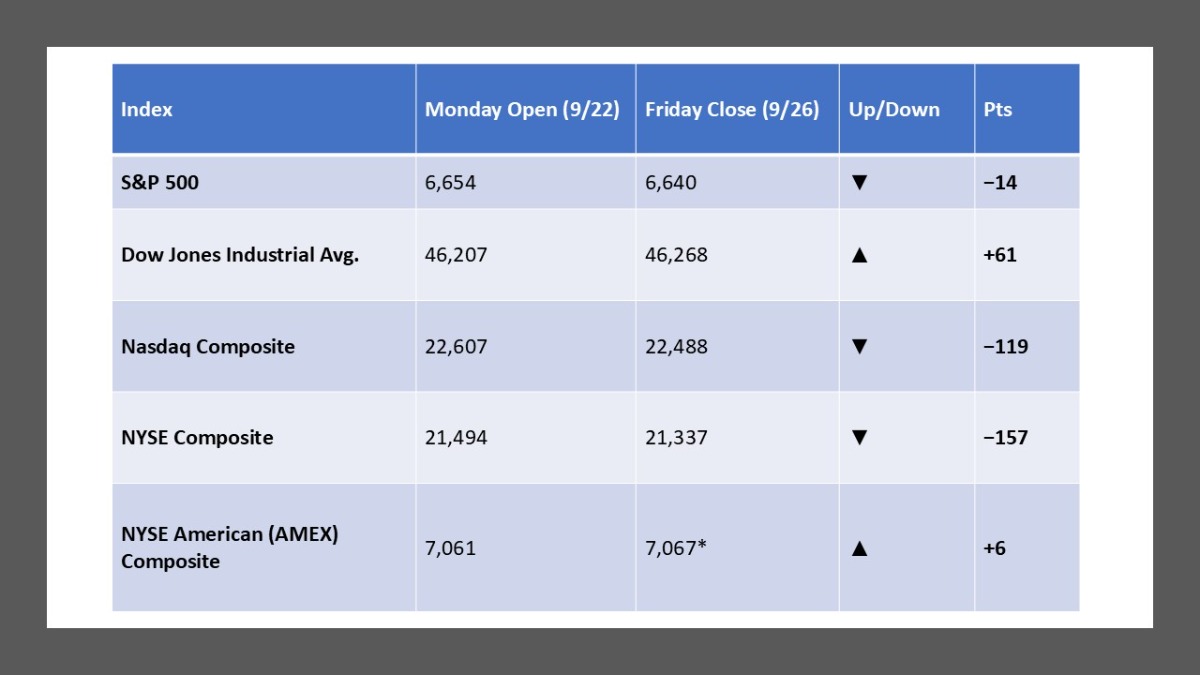

Here’s your wrap for Mon, Sep 22 – Fri, Sep 26, 2025 (rounded to the dollar).

Weekly Market Summary:

Stocks set fresh records to start the week, then slid for three straight sessions (Tue–Thu) before rebounding Friday to trim losses. Friday’s bounce came as inflation data landed roughly in line with expectations, easing fears the Fed would slow its cutting path. For the week, indexes finished mixed and just off highs, with the S&P and Nasdaq posting their worst weekly showing since late July despite Friday’s pop. A looming government-shutdown risk and new tariff headlines added macro noise, keeping intraday swings elevated. Within the Dow, Boeing and IBM were notable leaders on Friday, helping the average claw back from the midweek dip.

Five Stocks Worth Watching:

- Boeing (BA) — Among the biggest positive contributors to the Dow on Friday’s rebound.

- IBM (IBM) — Also boosted the Dow, reflecting strength in select mega-caps late week.

- Costco (COST) — Slipped post-earnings despite a beat, as renewal-rate and growth concerns weighed.

- Intel (INTC) — Caught a bid into Friday alongside chip peers on industry news flow.

- Paccar (PCAR) — Popped ~5% in the broader Friday rally; a nice barometer for industrial demand.

What The Prediction Markets Says (As Of September 19, 2025):

- Polymarket — “U.S. government shutdown in 2025?”: Active market on whether a shutdown occurs this year; odds firmed as the Sep-30 deadline approached.

- Kalshi — “Fed decision in October (Oct 29, 2025)”: Contracts price the size/probability of the next move after September’s cut (25 bps vs. hold vs. >25 bps).

- PredictIt — “Which party will win the U.S. House in 2026?”: Liquid U.S. politics contract tracking control of the chamber.

- Smarkets — “2028 U.S. Presidential Election winner”: Exchange odds currently show JD Vance as a leading single-name favorite among individuals.

- Manifold — “Fed in November: cut size / more than 25 bps?”: Community forecasting around the post-September path (recent related market resolved NO on >25 bps).

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply