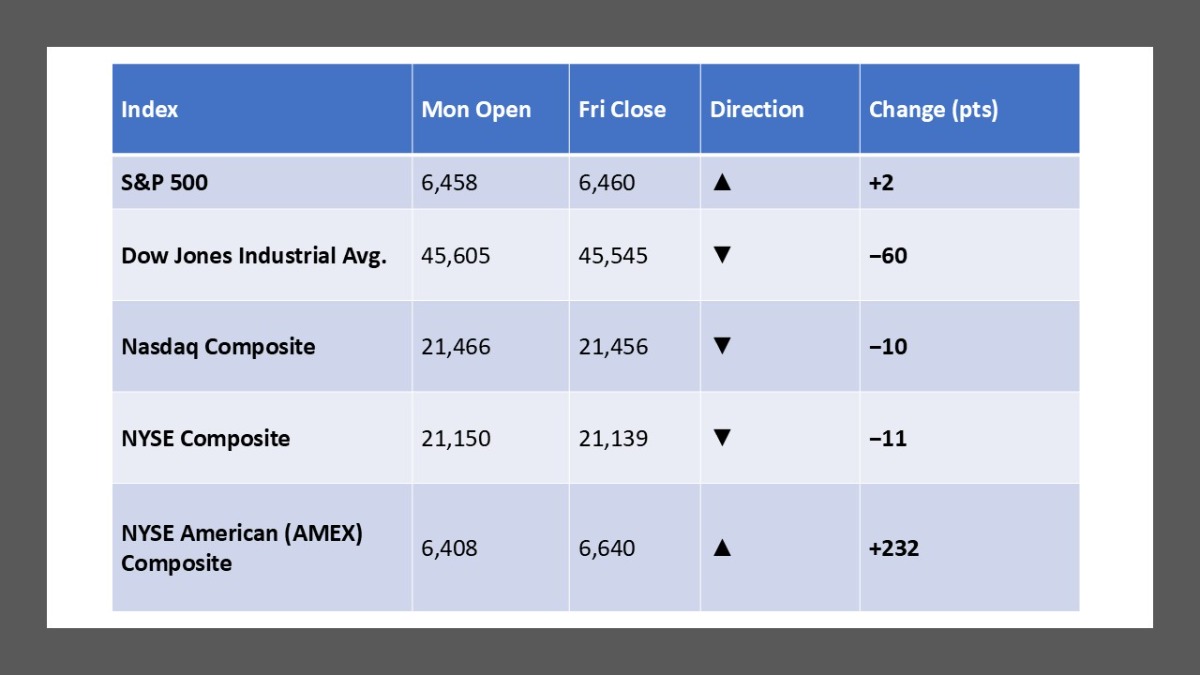

Here’s your report for the trading week Mon, Aug 25 – Fri, Aug 29, 2025:

Sources: Monday opens from Yahoo/Nasdaq/Investing.com; Friday closes from AP/Yahoo. S&P 500 open 6,457.67 (8/25); S&P 500 close 6,460.26 (8/29). Dow open 45,605.25 (8/25); Dow close 45,544.88 (8/29). Nasdaq open 21,466.47 (8/25); Nasdaq close 21,455.55 (8/29). NYSE Composite open 21,150.11 (8/25) and close 21,139.48 (8/29). NYSE American open 6,407.50 (8/25) and close 6,640.08 (8/29).

Weekly Market Summary

Stocks hit fresh records on Thursday after upbeat tech news and earnings—Nvidia strength, Snowflake guidance and HP’s outlook—before pulling back Friday on mixed PCE inflation and profit-taking in AI leaders. By the close Friday, the S&P 500 −0.6%, Nasdaq −1.2%, and Dow −0.2% still left August up ~1.9% for the S&P, its fourth straight monthly gain. Tech weakness (Dell, Marvell, Nvidia) led the retreat, while select software names (Autodesk) bucked the trend. Traders continued to pencil in a September Fed rate cut after Powell’s dovish tilt and steady headline PCE (2.6% y/y) even as core PCE ticked to 2.9%. Net-net, breadth cooled from midweek highs, but major indexes remain near records heading into Labor Day.

Five Stocks Worth Watching

- Dell (DELL) — sank ~9% Friday on margin pressures despite solid revenue; closely watched as an AI hardware bellwether.

- Marvell Technology (MRVL) — tumbled ~19% on weak guidance; a clean read-through on AI networking demand.

- Nvidia (NVDA) — slipped as investors rotated after a record-setting streak; its moves still steer broad tech.

- Autodesk (ADSK) — jumped ~9–11% on stronger forecasts; notable software winner amid tech volatility.

- Snowflake (SNOW) — popped on AI-driven revenue outlook; emblematic of data/AI enthusiasm supporting late-week highs.

What The Prediction Markets Says (As Of August 22, 2025):

- September FOMC: 25 bp rate cut? — Polymarket’s “Fed decision in September” is the high-liquidity contract (≈$52M traded) with recent coverage pegging odds around ~80% for a cut.

- Largest company by market cap on Aug 31, 2025 — End-of-month crown market with ~$1.06M volume; traders handicap whether Nvidia or Microsoft finishes August on top.

- Best AI model by year-end 2025 (Chatbot Arena rules) — A popular AI leaderboard market (≈$2.65M volume) tracking who leads the LLM race by Dec 31.

- How many Fed cuts in 2025? — Actively traded on Kalshi (distribution-style contracts) and Polymarket (variants), used by traders to map the cut path.

- Bitcoin’s 2025 peak — A high-interest bracket market (≈$24M volume) that captures the year’s risk appetite across crypto.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply