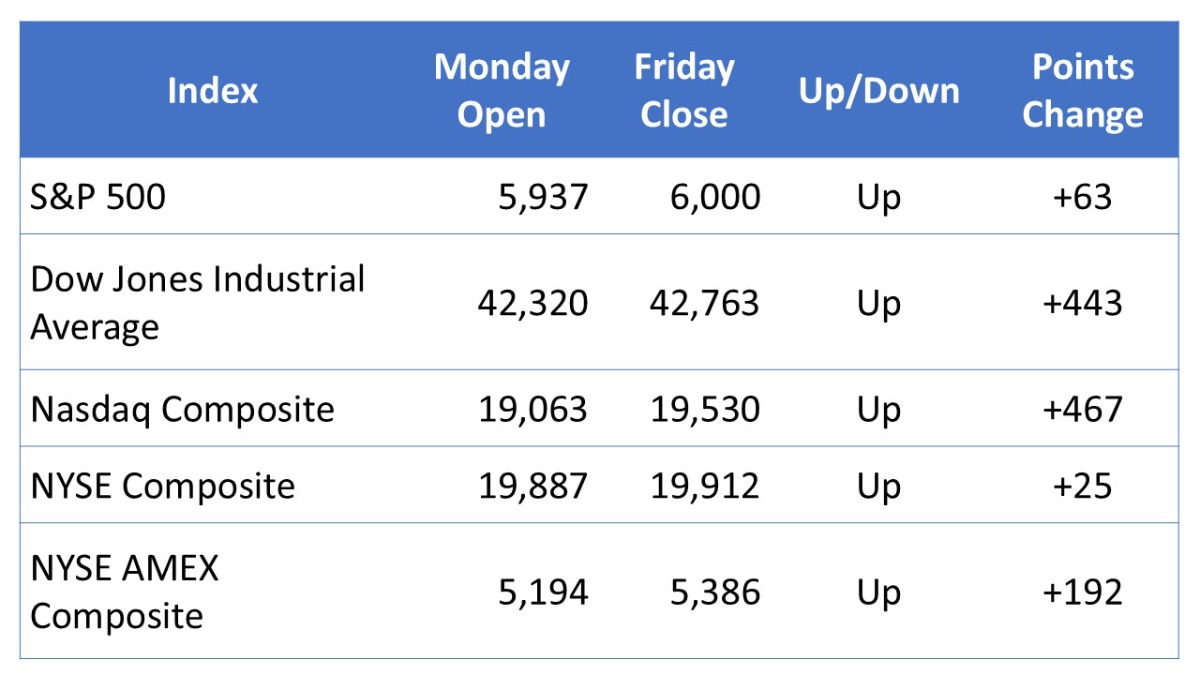

During the week of June 2 to June 6, 2025, U.S. stock markets experienced a notable rebound, buoyed by a favorable jobs report and easing trade tensions. Below is a summary table of the performance of major stock market indexes:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary:

The week commenced with modest gains, as the S&P 500 and Nasdaq Composite rose by 0.4% and 0.7%, respectively, while the Dow Jones Industrial Average added 0.1%, reflecting investor optimism amid easing trade tensions. Midweek, markets remained relatively stable, digesting economic indicators and awaiting the U.S. jobs report. On Friday, a better-than-expected employment report, showing 139,000 jobs added in May, propelled markets higher, with the S&P 500 closing above the 6,000 mark for the first time since February 21. The Dow Jones Industrial Average and Nasdaq Composite also posted significant gains, rising by 1% and 1.2%, respectively. This positive momentum marked the second consecutive weekly gain for major indexes, signaling renewed investor confidence.

Stocks Worthy of Attention:

- Tesla Inc. (TSLA): The electric vehicle manufacturer’s stock rose 3.7% on Friday, outperforming competitors, as it rebounded from a two-day losing streak amid broader market gains.

- Dell Technologies Inc. (DELL): Shares increased by 1.73% on Friday, surpassing market performance, despite trading volumes remaining below the 50-day average.

- Meta Platforms Inc. (META): The company’s stock climbed 3.6% on Monday, following reports of plans to launch an AI-driven advertising service by the end of the year.

- Nvidia Corp. (NVDA): The semiconductor giant’s shares gained 1.7% on Monday, continuing its upward trajectory amid strong demand for AI-related technologies.

- Broadcom Inc. (AVGO): The chipmaker’s stock rose 2.7% on Monday, reflecting investor confidence in the tech sector’s resilience.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM

AND IS FINANCIALLY SPONSORED BY THAT SERVICE.