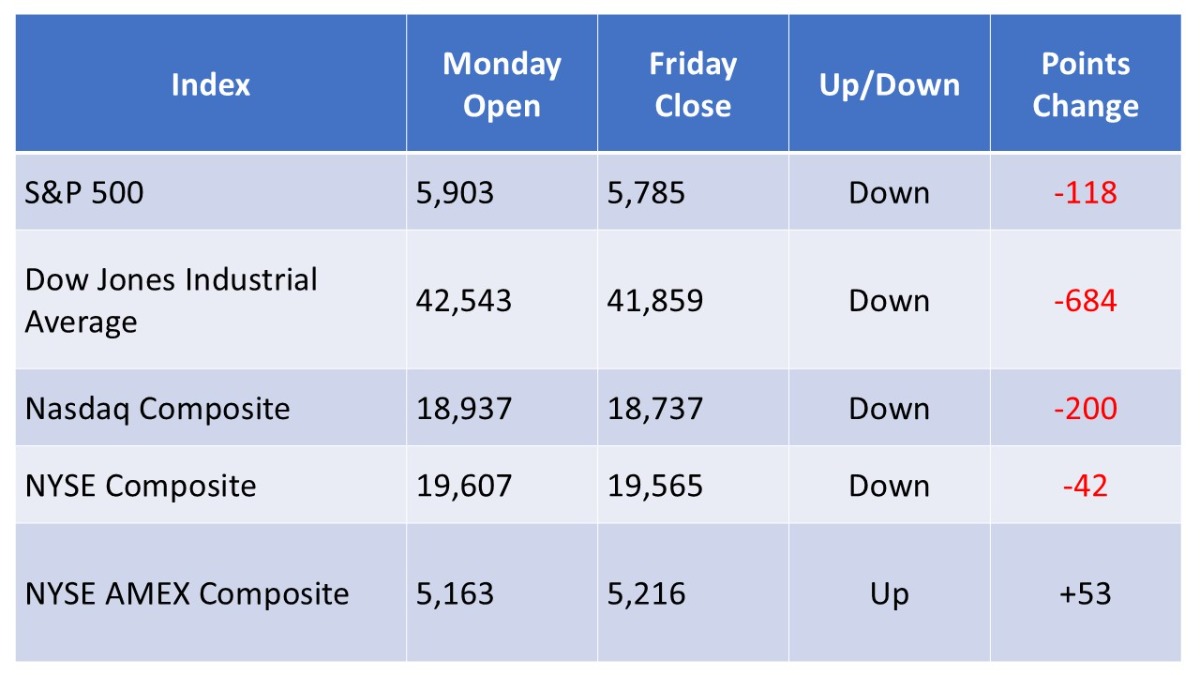

During the week of May 19 to May 23, 2025, U.S. stock markets experienced volatility, influenced by trade tensions and economic indicators. Below is a summary table of the performance of major stock market indexes:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary:

The week began with the S&P 500 closing higher for the sixth consecutive day on Monday, as investors digested U.S. credit rating news. However, midweek saw a sharp decline, with the Dow dropping 800 points on Wednesday amid surging bond yields and deficit concerns. On Friday, markets opened with significant losses following President Trump’s announcement of a 50% tariff on European Union imports and a 25% tariff on Apple products not manufactured in the U.S., leading to declines in major indexes. Despite these fluctuations, the NYSE AMEX Composite managed to post a gain for the week, reflecting resilience in certain market segments.

Stocks Worthy of Attention:

- Apple Inc. (AAPL): Shares declined following President Trump’s tariff threats on non-U.S.-manufactured Apple products, potentially impacting the company’s supply chain and profitability.

- Nvidia Corporation (NVDA): The semiconductor company’s stock experienced volatility amid broader market fluctuations and concerns over trade policies affecting the tech sector.

- Tesla Inc. (TSLA): Tesla’s shares showed resilience, with investors focusing on the company’s growth prospects despite market-wide downturns.

- Palantir Technologies Inc. (PLTR): The data analytics firm’s stock gained attention as investors assessed its government contracts and potential in the defense sector.

- Applied Materials Inc. (AMAT): Despite a Q2 revenue miss, the company’s stock remained stable, reflecting investor confidence in the long-term outlook for the semiconductor equipment industry.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.