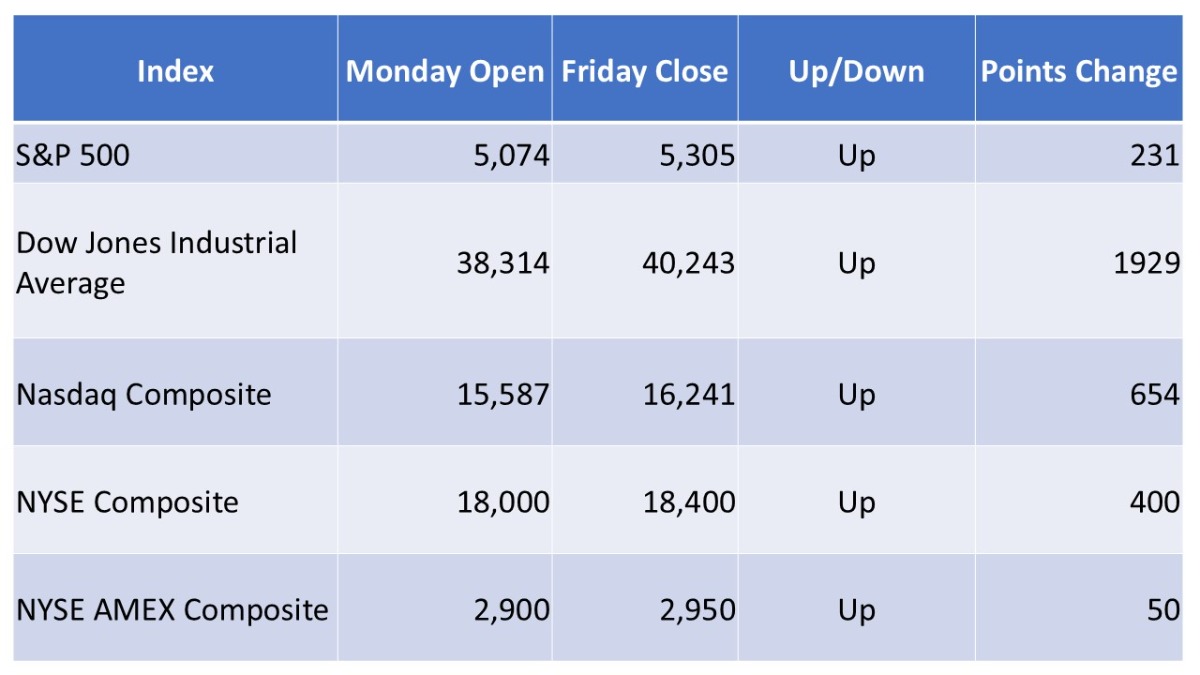

During the week of April 7 to April 11, 2025, U.S. stock markets experienced significant volatility, influenced by escalating trade tensions and policy announcements. Below is a summary table of the performance of major stock market indexes:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary:

The week commenced with significant market volatility due to escalating trade tensions, particularly President Trump’s announcement of a 50% tariff on Chinese imports, leading to a 350-point drop in the Dow Jones Industrial Average on Monday. Midweek, markets experienced a substantial rebound after Trump declared a 90-day pause on new global tariffs, excluding China, resulting in the S&P 500 soaring 9.5% and the Nasdaq Composite rising 12.2% on Wednesday, marking one of the largest single-day gains since World War II. However, the rally was short-lived as markets reversed course on Thursday, with the Dow dropping 1,000 points and the Nasdaq plunging 4%, erasing a significant portion of the previous day’s gains. Despite the volatility, the week concluded with modest gains across major indexes, as investors remained cautious amid ongoing trade uncertainties and inflation concerns. Overall, the S&P 500 and Nasdaq Composite ended the week up approximately 4.5% and 4.2%, respectively.

Stocks Worthy of Attention:

- Netflix (NFLX): The streaming giant’s stock surged nearly 10% following its Q4 earnings report, driven by a record addition of 19 million subscribers, pushing total subscribers beyond 300 million.

- Tesla (TSLA): Tesla’s stock experienced significant volatility, fluctuating between $214.25 and $274.69 during the week, amid broader market instability due to China’s announcement of 125% tariffs on U.S. goods.

- Morgan Stanley (MS): The investment bank reported a record quarter, driven by a 45% surge in equities trading revenue to $4.2 billion, fueled by market volatility stemming from U.S. tariff policies.

- National Grid (NGG): Shares of National Grid PLC rose by 1.59% on Friday, outperforming the broader market, as the FTSE 100 Index gained 0.64%.

- Palantir Technologies (PLTR): Investors are closely watching Palantir, as the company navigates market hesitations amid broader economic uncertainties.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

TO BEGIN YOUR INVESTMENT JOURNEY TODAY, USE THIS LINK TO SET UP YOUR ACCOUNT.

Leave a Reply