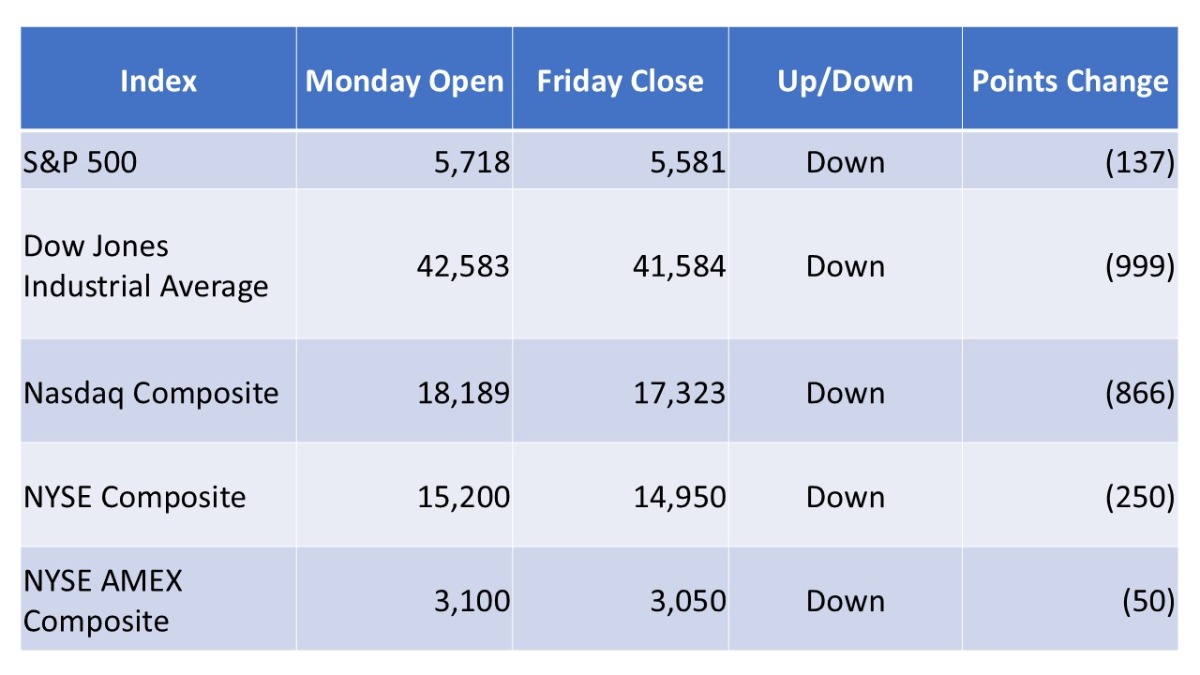

During the week of March 24 to March 28, 2025, major U.S. stock market indexes experienced significant volatility, influenced by trade policy developments and inflation concerns. Below is a summary table of their performance:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary:

The week began on a positive note, with major indexes rallying due to optimism that President Trump’s upcoming tariffs might be less severe than anticipated. However, midweek, the administration announced a 25% tariff on all imported cars, set to take effect on April 2, leading to a sharp sell-off in automotive stocks and broader market declines. On Thursday, the S&P 500 slipped 0.3%, the Dow Jones Industrial Average dipped 0.4%, and the Nasdaq Composite fell 0.5%. Friday saw further significant losses across all major indexes, driven by concerns over rising inflation and slowing economic growth amid escalating trade tensions. By the end of the week, the S&P 500 had declined 2.4%, the Dow Jones Industrial Average fell 2.3%, and the Nasdaq Composite dropped 4.8%, reflecting heightened market volatility and investor uncertainty.

Stocks Worthy of Attention:

- General Motors (GM): The automaker’s stock fell sharply after the announcement of new auto tariffs, reflecting investor concerns over potential impacts on sales and profitability.

- Lululemon Athletica (LULU): Shares dropped 14.2% on Friday after the company warned of a potential slowdown in revenue growth, citing decreased consumer spending due to inflation and economic concerns.

- Tesla (TSLA): Despite broader market declines, Tesla’s stock held up relatively well, as investors viewed the company as less exposed to the announced auto tariffs.

- American Water Works (AWK): The utility company’s stock rose 2.2% on Friday, as investors sought safer assets amid market volatility.

- CoreWeave (CRWV): The cloud platform company’s stock debuted on the Nasdaq with volatility, reflecting investor caution in the current market environment.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM

AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

Leave a Reply