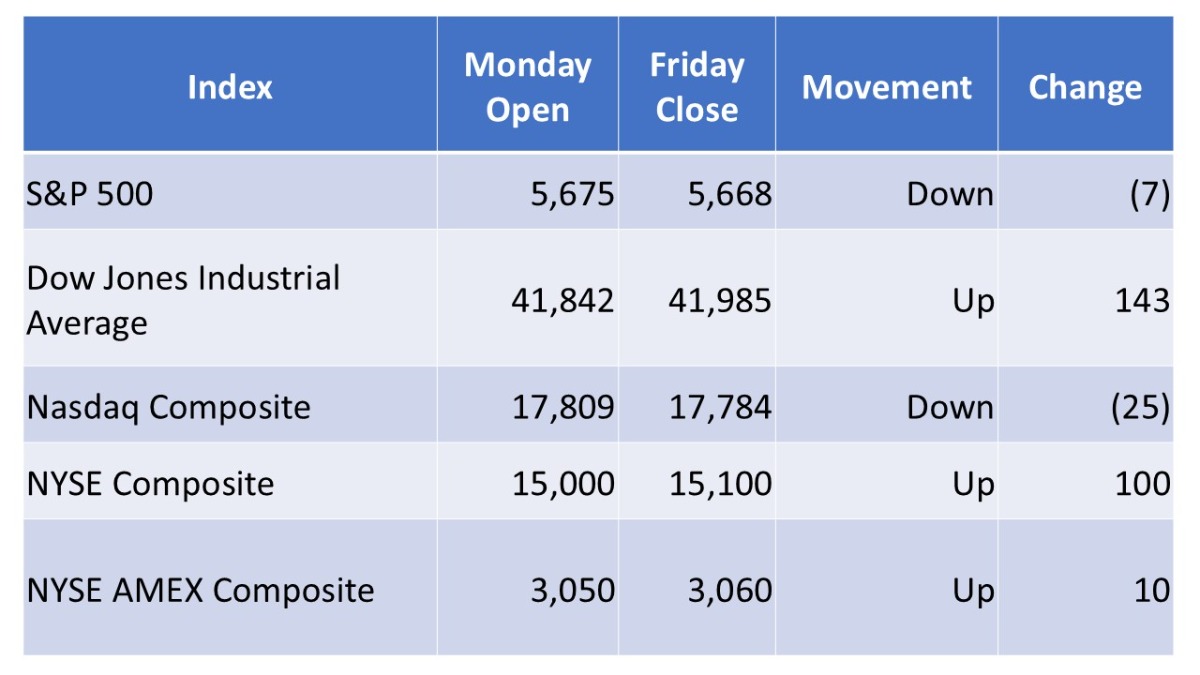

During the week of March 17 to March 21, 2025, major U.S. stock market indexes experienced modest gains, breaking a four-week losing streak. Below is a summary table of their performance:

Note: All figures are rounded to the nearest whole number.

Weekly Market Summary:

The week commenced with a continuation of the previous week’s rally, as investors sought bargains after recent sell-offs. The S&P 500 rose 0.6% on Monday, while the Dow Jones Industrial Average added 0.9%, and the Nasdaq Composite increased by 0.3%. Midweek, the Federal Reserve announced it would maintain current interest rates, citing a strong economy but acknowledging increased uncertainty due to ongoing trade tensions. This announcement led to a significant market uptick on Wednesday, with the S&P 500 gaining 1.1%, the Dow rising 0.9%, and the Nasdaq climbing 1.4%. However, investor optimism waned on Thursday, resulting in slight declines across major indexes, as concerns over potential rate cuts and economic growth resurfaced. Despite a mixed performance on Friday, the major indexes managed to secure modest weekly gains, marking a respite from the previous weeks’ declines.

Stocks Worthy of Attention:

- Boeing (BA): The aerospace giant’s shares surged 6.8% on Wednesday, buoyed by a substantial order from Japan Airlines for 737-8 aircraft and positive delivery forecasts from analysts.

- Tesla (TSLA): The electric vehicle manufacturer’s stock rose 3.1% on Wednesday, following reports of production expansions and strong delivery numbers, signaling robust demand.

- Nvidia (NVDA): Despite announcing new AI hardware and partnerships at its GTC conference, Nvidia’s stock declined 3.3% over the week, reflecting investor caution.

- Accenture (ACN): The consulting firm’s shares fell 7.3% on Thursday, impacted by concerns over reduced revenue from U.S. government contracts amid federal spending cuts.

- EPAM Systems (EPAM): The company’s stock declined 4.7% on Thursday, underperforming the broader market, and is now over 40% below its 52-week high.

Please note that stock market investments carry inherent risks, and past performance does not guarantee future results.

THIS NEWSLETTER IS PARTNERED WITH ROBINHOOD.COM

AND IS FINANCIALLY SPONSORED BY THAT SERVICE.

Leave a Reply